International Financial Reporting Standards (CIFRS) are a set of accounting standards that govern how particular types of transactions and events should be reported in financial statements. They were developed and are maintained by the International Accounting Standards Board (IASB). The IASB’s objective is that the standards be applied on a globally consistent basis to provide investors and other users of financial statements with the ability to compare the financial performance of publicly listed companies on a like-for-like basis with their international peers. CIFRS are now used by more than 100 countries, including the European Union and by more than two-thirds of the G20

iN THE KNOW

Practitioner

We give solutions: Solution are refined and proposed to the best and most possible outcome, from calibrating scenario, understanding Project Manager’s concerns, and confirming project outcome (expectation from Project Manager).

We stand for simplicity: We understand barriers of great details to top Executives, and thus adopting outlook of the deliveries to Project Manager’s or entrepreneur’s needs and transform into more generic.

We do amazing projects: General projects (e.g. Bookkeeping, Reporting, and Taxation) are delivered diligently and prudently, while specalised projects (e.g. fund raising, business plan, and CIFRS conversion) are genuinely planed, executed, monitored, and concluded. We delivered what we promised.

We do it on time: We are embedded with professional commitment and have accomplished series of project without complaint of timeline. Our team knows exact consequence of missing deadline. Project Manager is constantly kept informed of project progress.

Our Services

We are Driven by Creating Experiences that Deliver Results for your Business and for your Consumers.

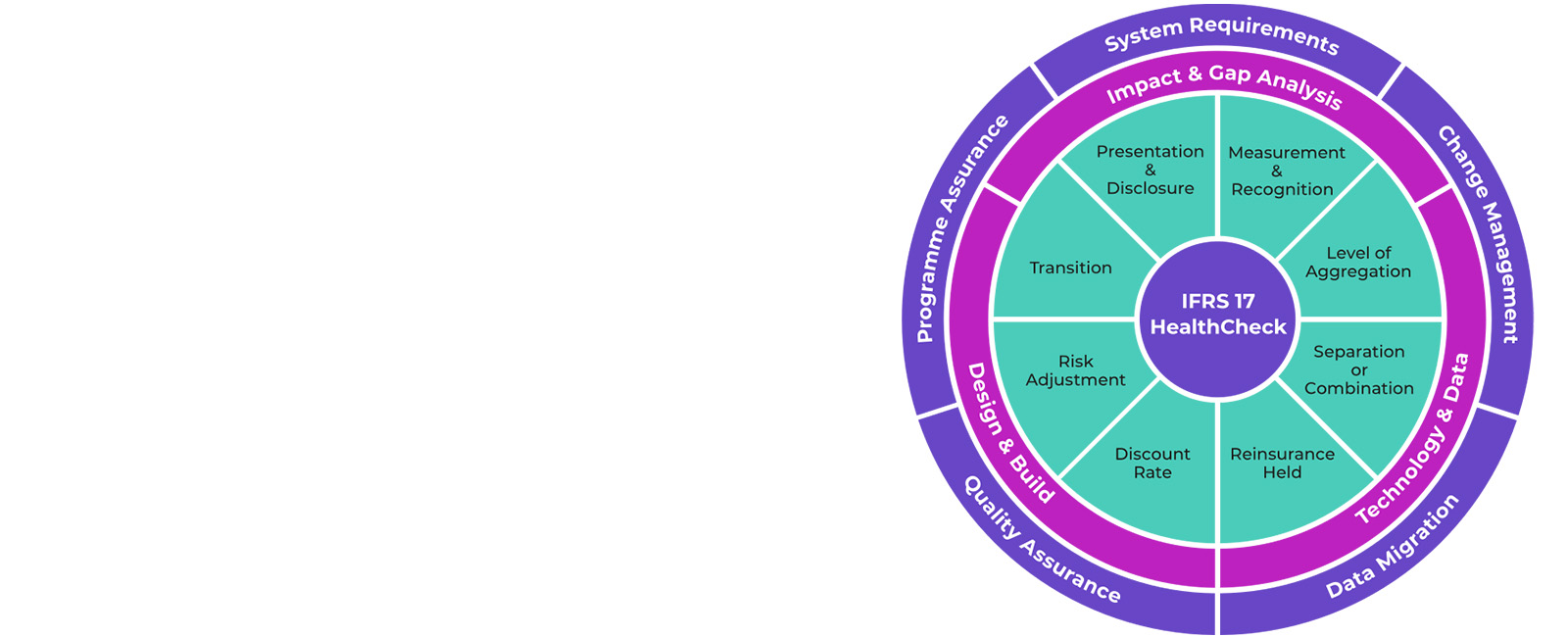

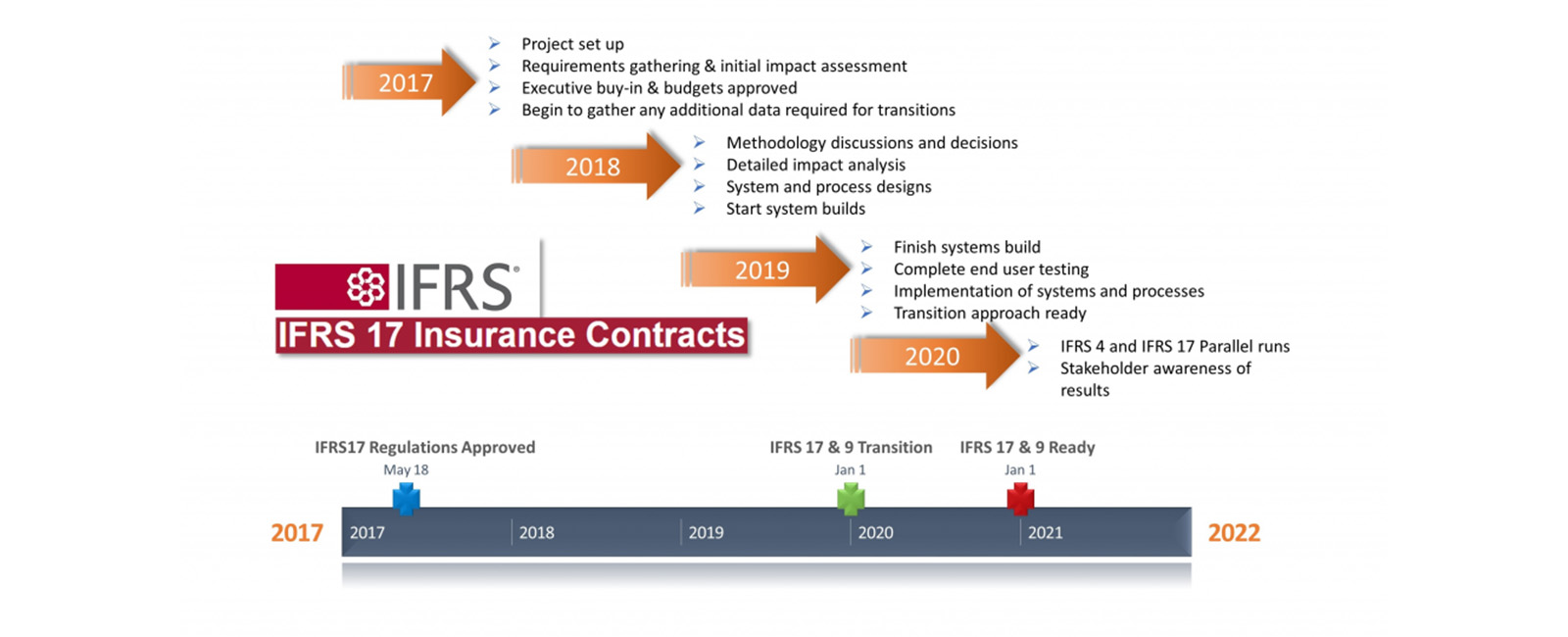

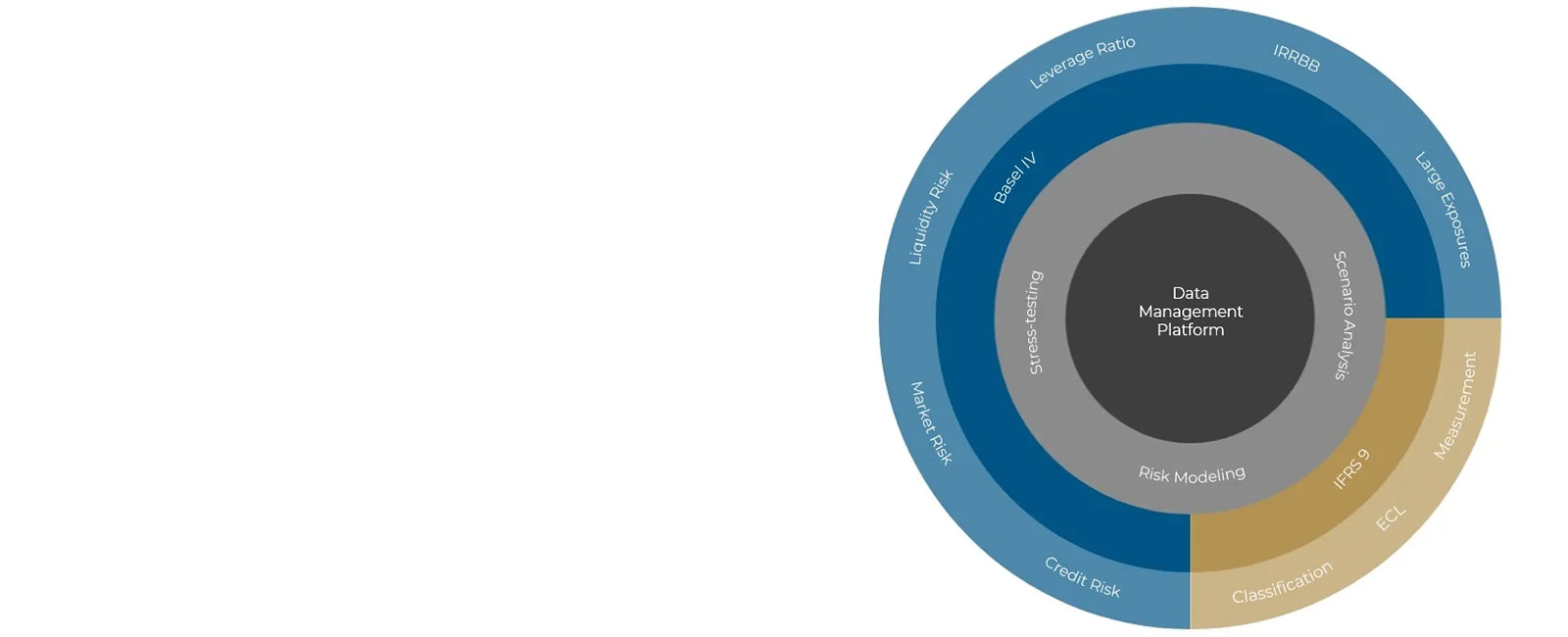

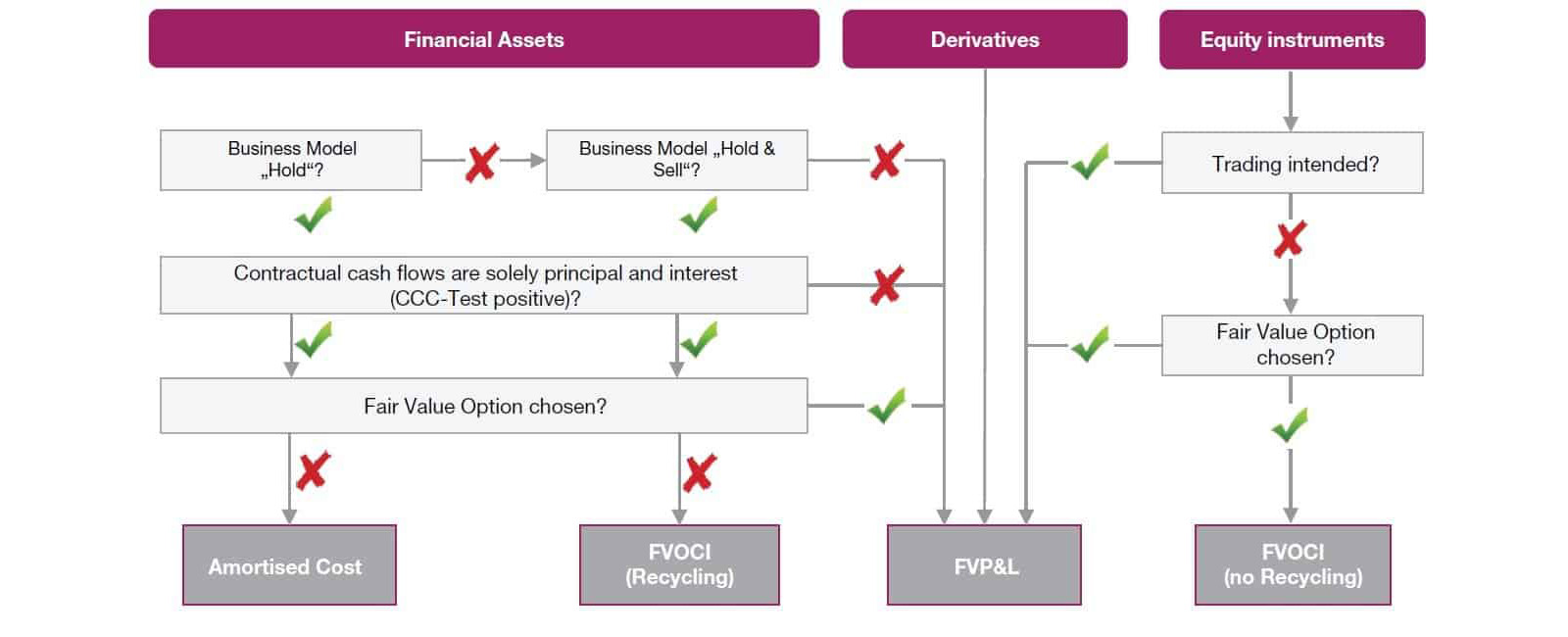

All ServicesCIFRS Conversion

Assessment, Progress, Knowledge Transfer, and First Time Adoption.

Financial Reporting

To record, process, and report of business-related transactions.

Taxation

To provide trusted services and become your primary consultant or tax agent.

Management Accounting

To organize and analyze cost center, revenue center, and profit center and report customization.

Assurance and audit

financial audit for being compliant with regulator, quarterly review, internal audit (project, department, internal process).

Credit Scoring

Fitted for CIAS 39 (incurred losses impairment) and CIFRS 9 (ECL) incorporating forward looking information, deriving from parametric statistical technique and supported hypothetical testing. Indicators are prudential selected and tested.

Impairment for CIAS 39 & CIFRS 9

Complete elements of EAD, PD, LGD, Discount rate, for individual and collective.

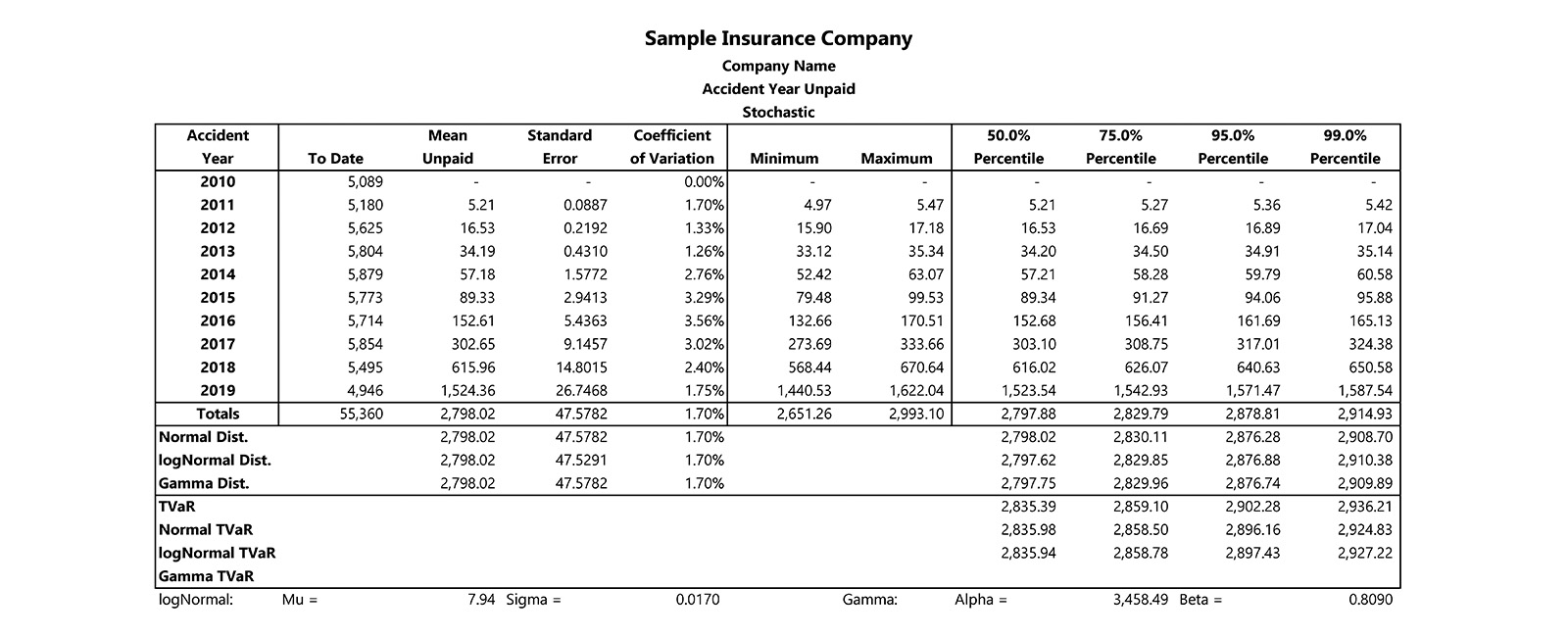

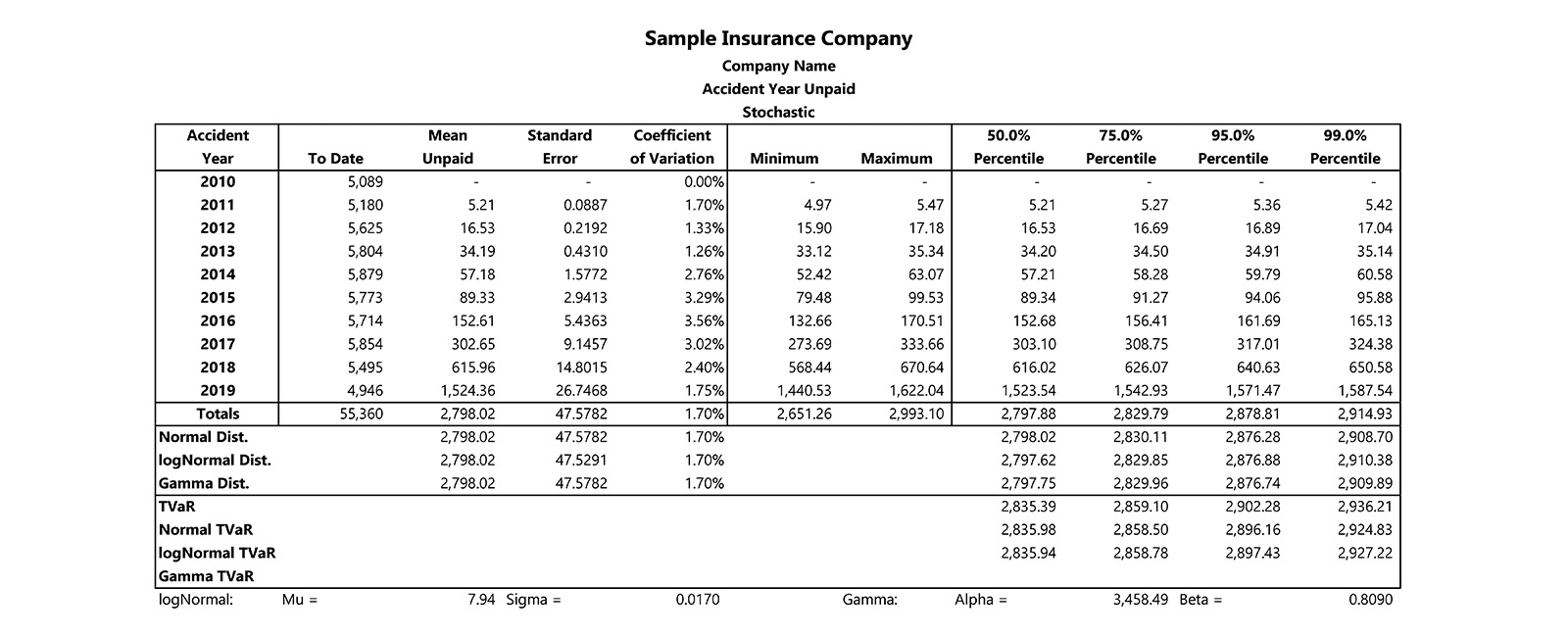

Insurance Contract Liabilities

incurred and reported, incurred but not reported, incurred but not sufficiently reported, provision for adverse deviation, unexpired risk reserve by deploying quantile technique and stochastic.